- The original investment you made in the property minus the value of the land on which it sits.

- Certain items like legal, abstract or recording fees incurred in connection with the property.

- Any seller debts that a buyer agrees to pay.

What are the two rules of the exclusion on capital gains for homeowners?

Sale of your principal residence. We conform to the IRS rules and allow you to exclude, up to a certain amount, the gain you make on the sale of your home. You may take an exclusion if you owned and used the home for at least 2 out of 5 years. In addition, you may only have one home at a time.

How do I avoid capital gains on sale of primary residence?

Home sales can be tax free as long as the condition of the sale meets certain criteria: The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify.

What can you deduct from taxes when you sell a house?

Closing costs that can be deducted when you sell your home

These may include: Owner's title insurance. An owner's title insurance policy protects you against prior ownership claims on the property. Property taxes.

How do you calculate land basis?

- Start with the original investment in the property.

- Add the cost of major improvements.

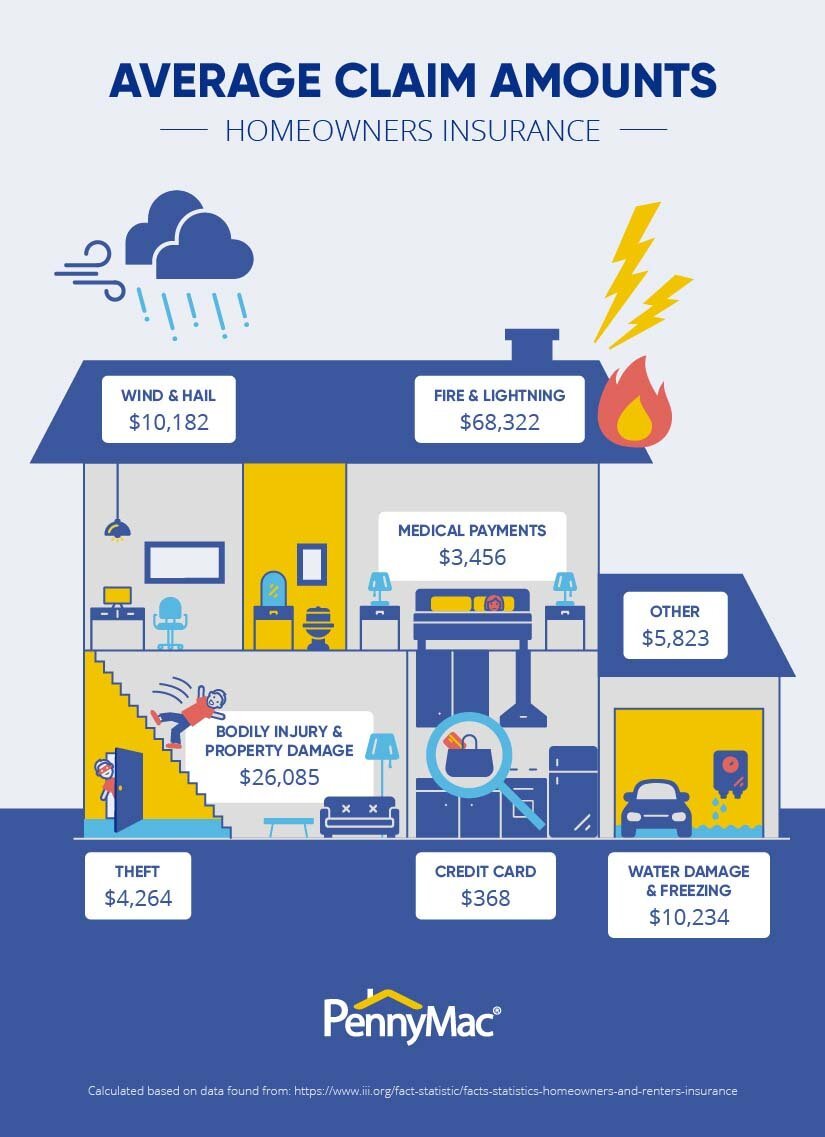

- Subtract the amount of allowable depreciation and casualty and theft losses.

How long do you have to live in a house to avoid capital gains tax IRS?

When does capital gains tax not apply? If you have lived in a home as your primary residence for two out of the five years preceding the home's sale, the IRS lets you exempt $250,000 in profit, or $500,000 if married and filing jointly, from capital gains taxes.

"She is getting sued by too many people and it's affecting THIS case, Your Honor" is a TERRIBLE argument. 🤣 Her lawyers know better, but when you have nothing.. you lay your nothing on the table. https://t.co/9SVmpCiSgw

— Larry Forman (@TheDUIGuyPlus) November 2, 2022

What is the 2 out of 5 year rule?

When selling a primary residence property, capital gains from the sale can be deducted from the seller's owed taxes if the seller has lived in the property themselves for at least 2 of the previous 5 years leading up to the sale. That is the 2-out-of-5-years rule, in short.

Frequently Asked Questions

How do you determine the gain on the sale of a house?

When you sell a house what is capital gains?

Capital gains are the profits made when you sell an appreciable asset, such as a house. For example, if you buy a home for $200,000 and sell it for $500,000, then you have a capital gain of $300,000. In California, capital gains are taxed by both the state and federal governments.

At what age do you not pay capital gains?

For individuals over 65, capital gains tax applies at 0% for long-term gains on assets held over a year and 15% for short-term gains under a year. Despite age, the IRS determines tax based on asset sale profits, with no special breaks for those 65 and older.

What are exceptions to 2 year rule sale of primary residence?

Exceptions to the Two-in-Five-Year Rule

You were separated or divorced during the time you owned your home. Your spouse died during the time you owned your home. The sale of your home involved vacant land.FAQ

- Is there capital gains tax on primary residence in 2023?

You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly.

- How much gain can you exclude from sale of home?

Hear this out loudPauseKey Takeaways

You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly.

- Is $500 000 lifetime capital gains exempt?

Hear this out loudPauseNot All Gain Is Taxable

There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

How long do i have to live in a house to claim a sale of residence

| What is the exclusion for home sale 2023? | Hear this out loudPauseThis means that when certain conditions are met, sellers can exclude up to $250,000 (for a single person) or $500,000 (married, filing jointly) of their profit from a home sale. |

| How long after I sell my primary residence to avoid capital gains? | The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify. The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. |

| Is capital gains exclusion for primary residence? | Avoiding capital gains tax on your primary residence You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years. |

- How to avoid capital gains tax on sale of primary residence?

You owned the home for fewer than two years

The agency requires that you have owned the home for at least two years in the five-year period before you sold it. You may catch a break here if you're married and filing jointly — only one of the spouses is required to meet this test.

- What is the 121 home sale exclusion?

The Section 121 Exclusion is an IRS rule that allows you to exclude from taxable income a gain of up to $250,000 from the sale of your principal residence. A couple filing a joint return gets to exclude up to $500,000.

- How does IRS determine primary residence?

The Rules Of Primary Residence

If you own one home and live in it, it's going to be classified as your primary residence. But if you live in more than one home, the IRS determines your primary residence by: Where you spend the most time.