30%

A popular standard for budgeting rent is to follow the 30% rule, where you spend a maximum of 30% of your monthly income before taxes (your gross income) on your rent. This has been a rule of thumb since 1981, when the government found that people who spent over 30% of their income on housing were "cost-burdened."

How do you calculate monthly rent?

We multiply the weekly rent by the number of weeks in a year. This gives us the annual rent. We divide the annual rent into 12 months which gives us the calendar monthly amount. Remember your rent is always due in advance so should you wish to pay monthly then your rent must be paid monthly in advance.

How much house can someone afford?

With a FHA loan, your debt-to-income (DTI) limits are typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income.

How much rent can I afford based on salary UK?

As a rough estimate, at least from a landlord's or agency's perspective, you should be earning around 2.5 times the rental amount. This isn't set in stone but it will give you an approximate indication of what you should expect to afford.

How much should I spend on a house if I make 100k?

“Assuming other factors such as creditworthiness and debt-to-income ratio are favorable, someone with a $100,000 salary could potentially afford a home in the range of $300,000 to $400,000,” said Boyd Rudy, team leader and associate broker with MiReloTeam Keller Williams Realty Living.

What is the formula to calculate rental fee?

The simplest way to determine how much rent to charge for a house is the 1% Rule. This general guideline suggests that you charge around 1% (or within 0.8-1.1%) of your home's total market value as monthly rent payments.

What is the rental rate?

Rental rate. the periodic charge per unit for the use of a property. The period may be a month, quarter, or year. The unit may be a dwelling unit, square foot, or other unit of measurement.

Frequently Asked Questions

Can I afford a 500k house on 120k salary?

To afford a $500,000 house, you need to make a minimum of $91,008 a year — and probably more to make sure you're not house-poor and can afford day-to-day expenses, maintenance and other debt, like student loans or car payments. One good guideline to follow is not to spend more than 28 percent of your income on housing.

What percent of income should go to rent?

30%

A popular standard for budgeting rent is to follow the 30% rule, where you spend a maximum of 30% of your monthly income before taxes (your gross income) on your rent. This has been a rule of thumb since 1981, when the government found that people who spent over 30% of their income on housing were "cost-burdened."

Is 120k a good household income?

FAQ

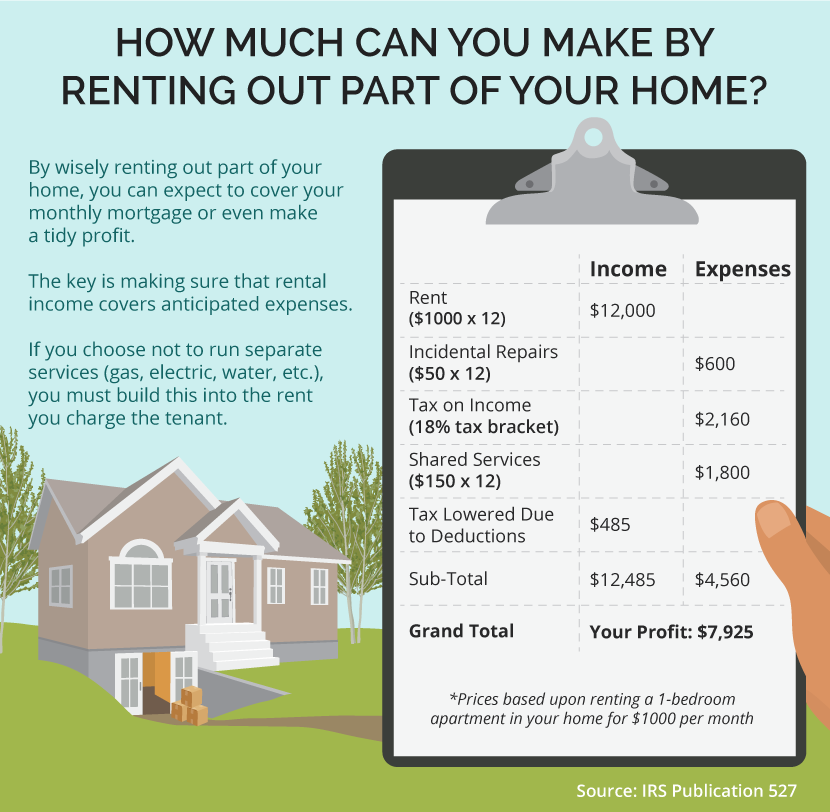

- How do you calculate rental income from a property?

Use the One Percent Rule. If you cannot obtain actual figures for a potential property, you can use the one percent rule of rental real estate to determine cash flow. Simply put, a property's rental rate should be at least 1% of the total property value. For a $200,000 property, rental income should at least be $2,000.

- How do you calculate what rent should be?

The simplest way to determine how much rent to charge for a house is the 1% Rule. This general guideline suggests that you charge around 1% (or within 0.8-1.1%) of your home's total market value as monthly rent payments.

- How much rent is reasonable?

The 30% rule states that you should try to spend no more than 30% of your gross monthly income on rent.

How much rent for a house worth 130k

| What salary is needed for a 200K house? | So, by tripling the $15,600 annual total, you'll find that you'd need to earn at least $46,800 a year to afford the monthly payments on a $200,000 home. This estimate however, does not include the 20 percent down payment you would need: On a $200K home, that's $40,000 that needs to be paid in full, upfront. |

|||||||||||||||

| What are the monthly repayments on a 180k mortgage? | As an example, based on a standard repayment mortgage with a typical interest rate currently (October 2023) of 5.5% and a term length of 25 years, you should expect to pay £1,105 per month for this specific amount. |

|||||||||||||||

| How much deposit do I need for 180000? | What deposit is required for a £180k mortgage?

|

- How much does a 200K house cost a month?

As far as the simple math goes, a $200,000 home loan at a 7% interest rate on a 30-year term will give you a $1,330.60 monthly payment. That $200K monthly mortgage payment includes the principal and interest.

- Can I afford a 200k house on 50k a year?

- A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That's because your annual salary isn't the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.